The time of unrestrained shopping has already begun, thanks to Black Friday in November. This is swiftly followed by Christmas and New Year gift giving, and then the January sales.

But Kaspersky Lab is warning shoppers that cybercriminals targeting banking credentials or online shopping accounts could hit the jackpot this holiday season. As revealed in Kaspersky Lab’s report, From festive fun to password panic: Managing money online this Christmas, online shopping is one of the most popular activities on the Internet, only surpassed by email. And while the majority of people in South Africa (97%) are aware of financial cyberthreats, 53% have had their financial credentials fall into the wrong hands.

Out of the 53% of South Africans whose financial credentials were compromised, the survey revealed that 41% of them had never got their money back. Factors that can potentially put people’s finances at risk include the difficulty in controlling payment credentials’ after they have been used on different e-commerce platforms and the variety of payment methods available.

More than half of people (54%) are most worried about their financial credentials being accessed by cybercriminals. However, over a third (41%) of respondents have forgotten or not even tried to remember the websites and apps where they have shared their financial details.

As consumers try to ensure their payment credentials are easy to find and remember, almost of quarter of South Africans (24%) prefer to store them on devices. This can make submitting credentials more convenient when people do their shopping online, so they do not have to worry about forgetting them. However, if the device is lost or stolen, a user is at risk of not only losing their personal data but also their money, because someone could access their bank account if they found the respective credentials in the smartphone’s notes.

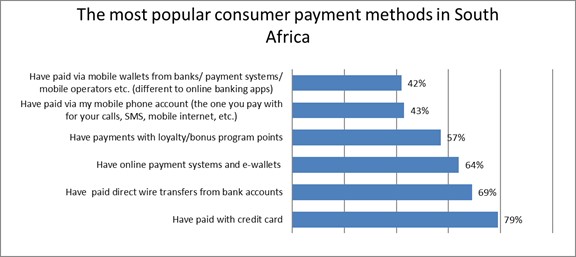

The wide range of digital payment methods gives shoppers the freedom to choose their favourite way of buying goods or services. The most preferable method is still debit and credit cards, direct transfers from bank accounts and e-wallets, e.g. PayPal. However, other payment methods are growing in popularity. Frequent shopping allows people to collect points via loyalty programmes and use them when revisiting a retailer to buy more. And thanks to smartphones and smartwatches, consumers don’t even need to carry around their wallet, physical money or even plastic cards. This has helped to raise the popularity of contactless device payments, such as PayPass and Apple Pay, with a third of shoppers (25%) using them regularly.

“The end of the year and the holiday season is a wonderful time when people are buying presents for their families and friends. But no one wants to have this time spoiled by losing money through unsafe transactions or online fraud,” said Marina Titova, Head of Consumer Product Marketing, Kaspersky Lab.

“We should all be very attentive to our financial data and online payments, taking care to avoid putting our bank card credentials on untrusted web sites or making payments from unsecured devices.”